Program Model Overview

1. Base Contributions

Universal Contribution Rate: 10% of Effective Income (EI) for all participants.

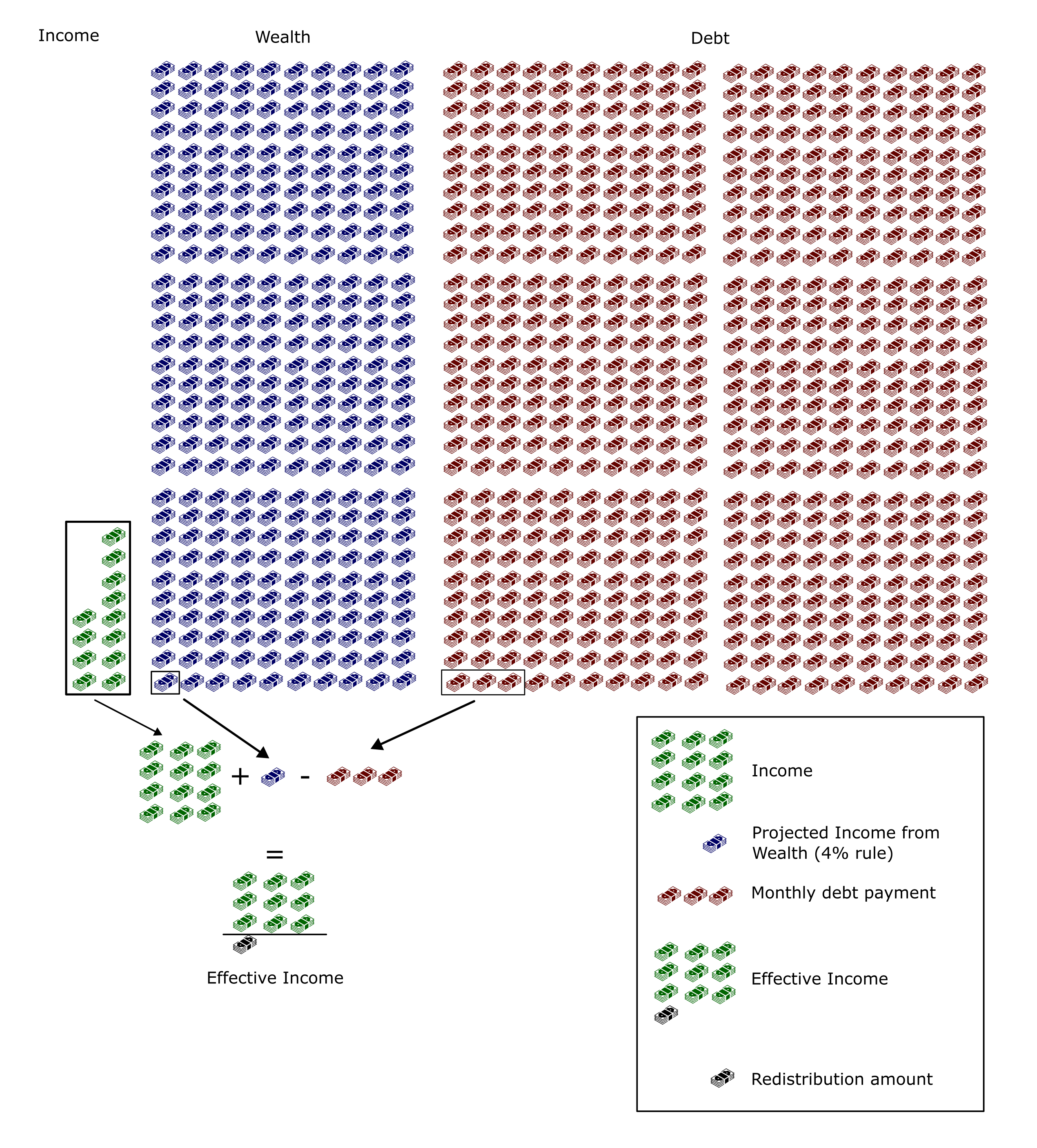

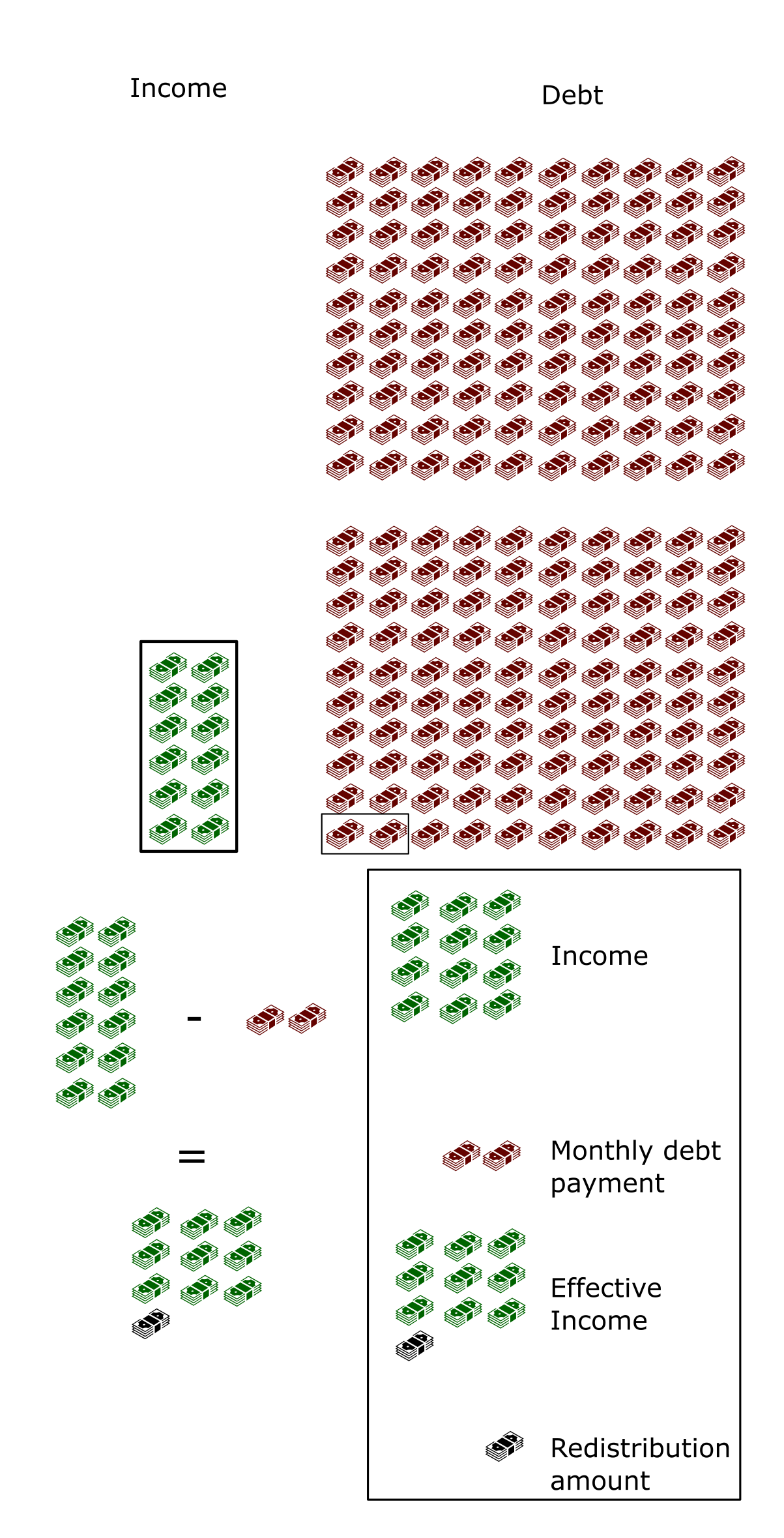

Effective Income (EI) formula: EI = actual income + imputed investment income from assets (4% FIRE rule) - eligible debt payments

Contributions are mandatory for participation, except when EI < 0, in which case contributions = $0. Participants may make additional voluntary contributions to the universal pool or their affinity group pool.

2. Affinity Groups

Optional, smaller groups within the program for higher internal income sharing.

Rules:

- Base 10% contribution to universal pool remains unchanged.

- Additional contributions within the affinity group are optional and only shared within that group.

- Purpose: natural test groups to explore different income-sharing models while maintaining the universal baseline.

3. Dynamic Equilibrium & PPP-Adjusted Payouts

Annual payout forecasts are announced at the start of each year. Payouts are PPP-adjusted for global participants to ensure equitable real purchasing power. Monthly contributions are reconciled with forecasted payouts. Bonuses may be applied if contributions exceed expectations.

Child members: Children may participate, but their payout is capped at 50% of an adult member’s payout to reflect partial benefits and costs.

4. Advance Payouts (Optional Lump Sum)

Participants may opt to receive their projected payouts as a lump sum advance at any time during the year, rather than receiving monthly payments.

Eligibility: Participants must have been a member for at least 12 months before they can access the lump sum advance option.

How it works:

- If a participant's projected monthly payout is $300, they can request an advance of any number of months (up to 12 months) at any point in the year.

- For example, if it's month 6 and they request 6 months, they would receive 6 months × $300 = $1,800. If they request 12 months, they would receive 12 months × $300 = $3,600.

- For the duration of the advance period, they receive no monthly payouts (they've already received their projected amount upfront).

- Protection clause (income decreases): If their actual reported income during any month is less than projected, they still receive a prorated monthly payout to ensure they don't fall below the standard baseline.

- Reconciliation clause (income increases): If their actual reported income during any month is greater than projected, they contribute additional funds that month to make up the difference, ensuring the advance remains balanced with their actual financial situation.

- This allows participants to access a larger sum upfront when it's most helpful (e.g., paying off debt, making a major purchase, covering emergency expenses), while maintaining fairness through monthly reconciliation.

Research rationale: Lump sum payments can be more effective than small monthly payments for addressing significant financial needs, reducing stress, and enabling strategic financial decisions.

Pool considerations: Advance payouts are funded from the buffer fund and require careful liquidity management to ensure the program can meet all obligations.

5. Operational Costs & Buffer Fund

Fixed operational percentage (e.g., 5%) is allocated from participant contributions to cover program costs. Voluntary donations and affinity group contributions are not subject to operational skim. All operational finances are fully transparent, visible to participants and government regulators.

Buffer Fund: Suggested rate of 5% of monthly inflows to absorb short-term fluctuations, support emergency payouts, and stabilize long-term solvency. Fully accounted for in transparency reporting.

6. Windfalls & Wealth Tax

One-time windfalls are treated as wealth, not regular income. Calculated as 10% of imputed annual income if invested using the 4% rule. Contributions from wealth/windfalls are tax-deductible as part of IRS 501(c)(3) contributions.

7. Debt Treatment

Eligible debt payments reduce Effective Income: mortgage, student loans, medical debt, or other essential debt payments. Participants never receive more than the standard payout, even if EI < 0. This encourages debt payoff while maintaining participant stability. Debt tracking is integrated into participant platform for automated EI calculation.

8. Admission, Exit, and Re-entry Policy

Admission / Re-admission: New participants and returning participants go through an application and evaluation process. Criteria include: alignment with program values, financial responsibility, history of exits/contributions, and engagement with community practices. Program may deny re-entry if repeated exits indicate risk to stability.

Re-entry / Returning Participants: Entry Count Penalty: each previous exit adds a flat 1% contribution period before ramping via doubling sequence to base rate (10%). No cap on flat period; repeated exits naturally delay full participation. Waitlist: may apply (1–3 months) before rejoining.

9. IRS / Legal Structure

Program structured as 501(c)(3) research/education nonprofit. Contributions are tax-deductible. Payouts are not considered taxable income for participants. Internal participant financial data remains private; government has access only to program-level transparency reporting. Program maintains compliance for international disbursement where applicable.

Legal Structure Comparison

The following table compares different legal structures considered for the Group Income Program and explains why 501(c)(3) was selected as the optimal choice.

| Structure | Tax-Deductible Contributions | Payout Tax Status | Research/Education Fit | Privacy & Transparency | Key Limitations |

|---|---|---|---|---|---|

| 501(c)(3) Nonprofit (Selected) |

✅ Yes — contributions are tax-deductible | ✅ Payouts treated as programmatic support, not taxable income | ✅ Excellent — research/education is core purpose | ✅ Strong — participant privacy protected; program-level transparency required | Must avoid private benefit; strict compliance requirements |

| LLC (Limited Liability Company) | ❌ No — contributions are not tax-deductible | ❌ Payouts likely taxable as income or distributions | ⚠️ Limited — primarily for business/for-profit activities | ⚠️ Moderate — less regulatory oversight, but also less protection | For-profit structure conflicts with mutual aid mission; tax disadvantages for participants |

| Quaker/Unincorporated Association | ⚠️ Limited — may qualify for 501(c)(3) but less formal structure | ⚠️ Unclear — depends on formal recognition | ⚠️ Possible — but less established framework for research | ⚠️ Less formal — may lack clear governance and transparency requirements | Less legal protection; unclear tax status; governance challenges at scale |

| Cooperative (Co-op) | ❌ No — member contributions are not tax-deductible | ⚠️ Patronage dividends may be taxable | ⚠️ Limited — focused on member benefit, not research | ✅ Good — democratic governance, but may require member disclosure | Tax disadvantages; member-owner model may conflict with open participation |

| Mutual Benefit Corporation | ❌ No — contributions are not tax-deductible | ⚠️ Payouts likely taxable | ⚠️ Limited — designed for member benefit, not public benefit | ⚠️ Moderate — less regulatory oversight than 501(c)(3) | Tax disadvantages; not designed for charitable/research purposes |

| Trust | ⚠️ Possible — if structured as charitable trust | ⚠️ Depends on trust structure | ⚠️ Limited — less flexible for ongoing operations | ⚠️ Trustee control may limit participant governance | Less flexible governance; may not fit dynamic program model |

Why 501(c)(3) is the Optimal Choice

- Tax advantages for participants: Contributions are tax-deductible, and payouts are treated as programmatic support rather than taxable income, maximizing the financial benefit to participants.

- Research/education alignment: The program's dual purpose of providing income stability while studying economic cooperation fits perfectly within the 501(c)(3) research/education classification.

- Privacy protection: Participant financial data remains private, while program-level finances are transparent to regulators and participants, balancing individual privacy with organizational accountability.

- Credibility and trust: 501(c)(3) status provides legal recognition, regulatory oversight, and public trust that supports long-term program stability and participant confidence.

- International compliance: The structure supports international disbursement while maintaining compliance with U.S. tax regulations.

- Long-term sustainability: The nonprofit structure aligns with the program's mission of mutual aid rather than profit, ensuring the organization's purpose remains clear and protected.

10. Economic Sustainability & Incentive Alignment

Addressing the "Race to Poverty" Concern: A critical question for any income-sharing system is whether it creates perverse incentives that could lead to a downward spiral where participants reduce income, shrinking the pool, and ultimately making the system unsustainable.

Built-in Safeguards

- 10% contribution rate preserves strong earning incentives: Participants keep 90% of their income, meaning the financial benefit of earning more almost always outweighs the benefit of reducing income to get a larger net payout. For example, earning $10,000 more per month increases net income by $9,000, which typically far exceeds any potential increase in program payout.

- Imputed investment income (4% rule): Even if participants stop working, their assets still count toward Effective Income. This means you can't fully escape contributions by reducing earned income—your wealth is still part of the calculation, reducing the incentive to "game" the system through income reduction.

- Equal payouts regardless of contribution: While this might seem like it creates an incentive to reduce income, it actually means that reducing your income doesn't increase your payout—you get the same payout whether you contribute $100 or $1,000. The only way to benefit from reducing income is if the payout is so large relative to your contribution that you'd be better off, which is mathematically unlikely at a 10% contribution rate.

- Buffer fund and dynamic equilibrium: The 5% buffer fund and annual payout forecasting create stability, but more importantly, if the pool shrinks, payouts decrease for everyone. This creates a collective incentive to maintain or grow the pool rather than shrink it.

- Community values and engagement: The program is designed for people who value mutual aid and economic cooperation, not just financial optimization. Monthly conversations, affinity groups, and shared values create social pressure and intrinsic motivation that goes beyond pure economic calculation.

- Exit/re-entry penalties: While participants can leave, re-entry comes with ramped contribution rates that delay full participation. This discourages opportunistic behavior while still allowing genuine exits.

Potential Risks & Mitigations

- Risk: High earners exit if they feel they're subsidizing others. Mitigation: The 10% rate means high earners still keep 90% of their income, and the tax-deductible nature of contributions provides additional benefit. Affinity groups allow high earners to form groups with similar income levels if desired.

- Risk: If payouts become very large relative to contributions, incentive to reduce income increases. Mitigation: This would require the pool to grow significantly, which itself indicates the system is working. The dynamic equilibrium model means payouts adjust based on actual contributions, creating a self-correcting mechanism.

- Risk: Coordinated reduction of income by many participants could shrink the pool. Mitigation: This would require widespread coordination and would harm all participants, including those who reduce income. The collective action problem works both ways—it's hard to coordinate to shrink the pool, just as it's hard to coordinate to grow it.

Why This Could Work

The system is designed as a research experiment to test whether income-sharing can work sustainably. Key factors that suggest it could:

- The 10% contribution rate is low enough that earning incentives remain strong while high enough to create meaningful redistribution.

- The program targets people who already value mutual aid and economic cooperation, not just anyone seeking to maximize personal financial gain.

- The imputed investment income rule prevents gaming through income reduction alone.

- Transparency and community engagement create accountability and shared investment in the system's success.

- The buffer fund and dynamic equilibrium provide stability and self-correction mechanisms.

- As a research/education nonprofit, the program can adapt policies based on data and learning, rather than being locked into a rigid structure.

This analysis is part of the ongoing research. The program will track income trends, contribution patterns, and pool health to continuously evaluate and refine the model.

11. Participant Platform

Tracks: income, debt, asset imputed income, contributions, payouts, and community engagement. Examples: using Empower/Personal Capital-like platform or custom-built solution.

Privacy: participant personal finances never shared outside the program unless voluntarily disclosed. Transparency: program finances (pool balances, distributions, operational costs) are fully open to participants and regulators.

12. Community Engagement

Participants hold 30-minute monthly conversations with rotating partners. Affinity groups may add additional engagement practices. Engagement is tracked for governance and re-entry evaluation.

13. Key Performance Indicators

- Income Stability: participants maintain consistent baseline income via program

- Retention & Engagement: participation rates, community conversation compliance

- Pool Health & Growth: total assets in the program, ability to onboard more participants over time

- Equitable Access: diversity of participant income levels, global PPP-adjusted equity

- Non-work Contribution: recognition that participants may not be earning income but are contributing to pool stability, engagement, or other community activities

- Long-term Resilience: ability to absorb windfalls, manage debt-adjusted EI, maintain buffer fund

- Experimental Metrics: effectiveness of affinity groups, impact of wealth tax, and contribution ramp structures